“Save it for a rainy day.” These words probably came from your grandmother when she handed you 50 cents for taking out the trash. Now “rainy days” are a lot more threatening then they were when you were 5. Granny was telling you to save some of that allowance and put it in your emergency fund.

Now that you are grown up, how much should you have in your rainy-day emergency fund? This can vary depending on things like your job stability, spousal income, personal preferences and more.

What is an emergency fund?

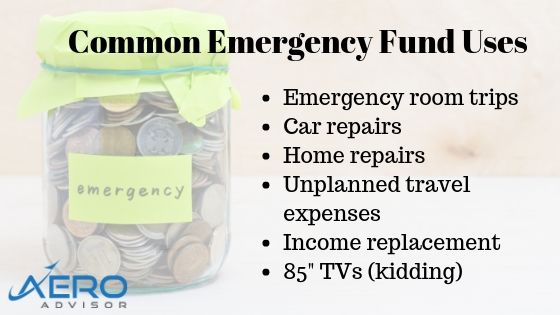

Before we talk about how much you should keep in the bank, maybe it’s a good idea to establish what the fund might be used for. An emergency fund is basically a pool of money that you have set aside to cover unexpected events.

Those unexpected events can be health care expenses like a trip to an emergency room or car repairs after getting into an accident. Realizing your TV might be too small to watch the game with your buddies is an example of what not to spend your emergency fund on.

As your budgeting skills get better, you’ll be able to set aside money each month for unplanned expenses like health care, car maintenance, home repairs, etc. Your goal should be to have more of the possible emergencies covered and have fewer expenses that might surprise you (and force you to pull money out of your emergency fund). Website tools like Mint.com and YNAB can help you with your budget.

How much should I keep in an emergency fund?

This can depend greatly on your job situation as well as your own personal preference. If you are a Dave Ramsey fan, he suggests having $1,000 in liquid savings until you are completely out of debt. The general consensus in the financial works is three to six months of expenses.

Your budget is a key factor in how much you might need. If you don’t know how much it costs each month for your family to live on, it’s really hard to determine how much you might need. For instance, if $25,000 is your emergency fund balance, that might be plenty for a family that has $4,000 a month in expenses. A family with $12,000 a month in expenses might be at more risk with that same emergency fund balance.

Employment

If you have a stable, long-term employment situation, then you might be ok with less than someone that is a contract worker with sporadic periods of time without work. You want your emergency fund to be able to pay the bills should you lose your source of income while you look for work or aren’t able to work.

If you are employed in a highly-specialized field where finding employment is relatively easy (doctors, nurses, engineers, etc.) than you could possibly be safe keeping only a few months of expenses in your emergency fund.

Spousal income

If you are a one-income household, you might want to keep additional funds in your emergency fund. Two-income households might be able to rely on the working spouse’s income if one spouse were to lose a job. Three months of expenses might be enough in this case.

Personal preferences

How much you are comfortable keeping in your emergency fund can greatly depend on your financial background. I’ve had clients with parents that grew up in the Great Depression and just felt comfortable having a lot more in cash than they might need. Life circumstances like previous financial struggles or bankruptcies might make people want to keep additional emergency funds.

Where should I keep my emergency fund?

So where do you keep your rainy day fund? You want to keep your emergency fund liquid where you can access it when you need it -usually in 24 hours or less. A bank account with a debit card linked that you can use at an ATM machine is usually best.

You can also keep it in a savings account if you can log into your bank account and quickly move funds into a checking account you can access.

Don’t worry about what you are earning

Checking and savings accounts don’t earn a whole lot. Unless you have more than six months of expenses in your emergency fund, then don’t worry about those pennies you are earning on your rainy day fund. The most important thing is having access to the funds. Putting cash in CDs, stocks, bonds, etc. might tie it up where it’s hard to access. It’s ok to shop around for rates, just make sure those higher rates still keep the same access to your cash.

Don’t invest it. The stock market is no place for your emergency fund. Stocks are great long-term investment vehicles but if a 2008-like dip pops up again and you have your emergency fund 100% invested in the market, then you could be setting yourself up for trouble. Undoubtedly an emergency need will pop up and your account will not have time to recover before you need it. It’s Murphy’s Law!

Related: What do I do when the market drops?

Need help with your emergency fund or retirement planning in general? Shoot me an email at Brian@TheAeroAdvisor.com

Content in this material is for general information only and not intended to provide specific advice or recommendations for any individual. There is no assurance that the techniques and strategies discussed are suitable for all individuals or will yield positive outcomes.