We did it this week…we officially crossed into Bear Market territory….another term for the broad market being down more than 20% from its peak. You’ve probably seen a scary bear or one like I used in the the blog banner above in a lot of articles talking about the current market. It’s the one I fear when I’m hiking with the family in Colorado. The giant grizzly that will no doubt hunt me down on the trail despite my attempt to zig zag downhill (is that really a thing?) or cover him with bear spray.

First….Bear Markets are never comfortable. You might get an uneasy feeling each time you open your statement or check your balances online. Your financial news outlets love to scare you even further with those pictures of a roaring bear. Why don’t they use a picture of a nice cuddly bear? Because you’d probably not have the same reaction – and wouldn’t share their articles or tell your neighbor about the article you read.

But how scared should we be of the bear and a Bear Market? Let’s look at a few questions that many people have when the markets are top-of-mind.

How often do these happen and how long do they last?

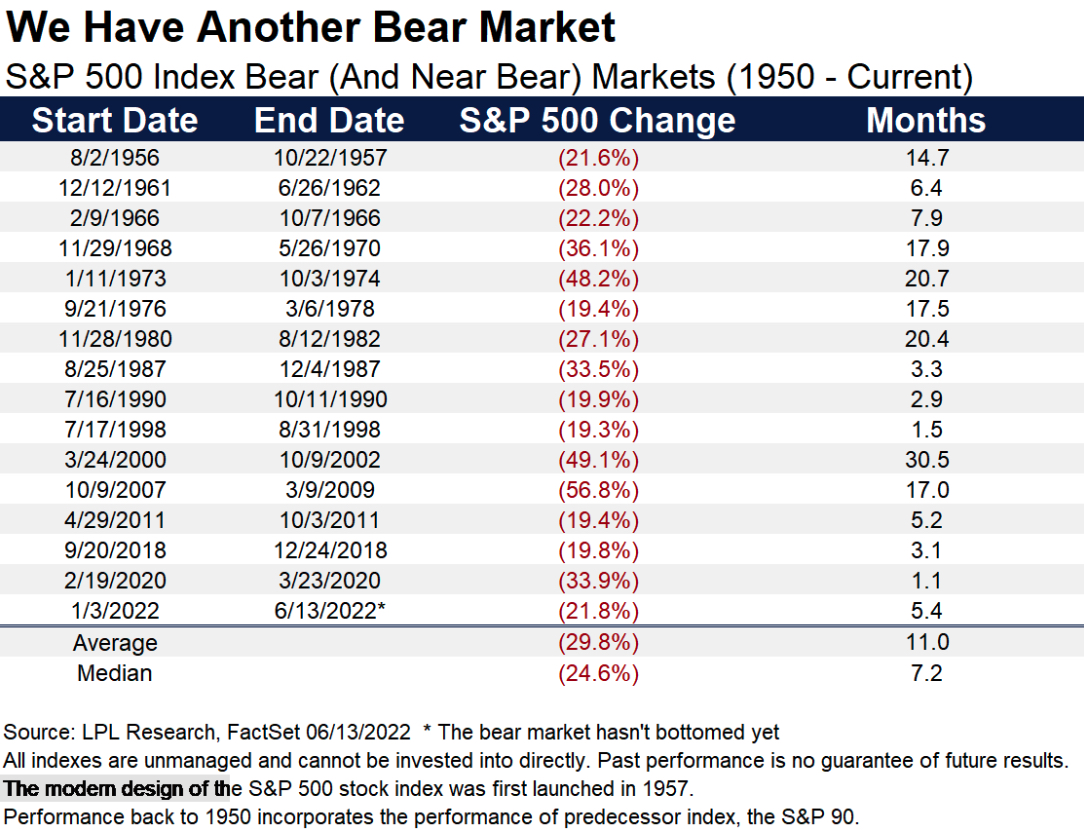

Since 1950, there have been 16 bear markets – that means that about every 4-5 years we see one. The last time we had one was in 2020 at the start of the pandemic.

According to the chart below from LPL Financial, the average Bear Market is 11 months long. We are in month five of the current pullback (they measure from the last market high). The last one in 2020 was the shortest in our history at just 1.1 months.

Should I do anything differently?

This depends on your individual financial situation and how your funds are invested. I’m a firm believer in putting a plan together for how you’ll react during market downturns before the market corrects. That way you can stick to your plan that you created before the emotional side is put into it. Focus on your long term goals and see if those have changed. A few course corrections might be ok, but ditching your well-thought out plan can really hurt your long-term financial success.

Side note: I don’t ever like any of my posts to feel sales-y. I want to get the info out there as much as possible and let you decide if hiring a financial advisor is the right thing for you to do. But these are the kinds of times when a financial planner can really earn the money you pay him or her. Having someone who can help you stick to your plan and keep you from making the mistakes (like going in and out of cash and trying to time the market) can really pay off in the long-run. If you haven’t heard from your financial advisor, CALL THEM (or me if they haven’t called you 😎). They can really help you find out how your goals have been affected (if at all). Ok! Back to your non-salesy, regularly scheduled, educational article.

Is this Bear Market different?

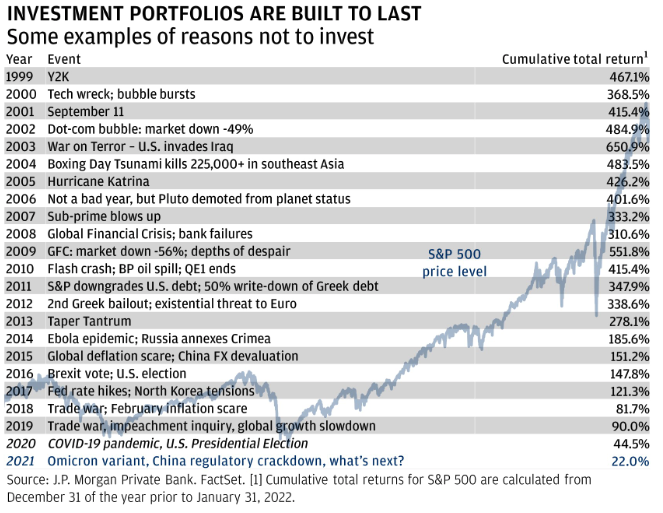

Sir John Templeton said “The four most dangerous words in investing are ‘This Time is Different.'” What did Mr. Templeton mean by that? These Bear Markets are usually caused by something different hitting our world, but most of them rebound after. The war in Ukraine and inflation spiking was a big factor in this Bear market, and there will probably be something different the next time. As the chart from JP Morgan below shows (read the full article by clicking HERE), there’s always a reason to be pessimistic about our future, but sticking to your long term plan might still be the best action.

Will the market recover?

The past is no guarantee of future results, but we can see in the chart below how the market has performed after we hit Bear Market territory.

So what should I do?

Focus on your long term goals. How have those changed? Have they changed at all? See how the recent market pullback might have affected your savings or retirement goals.

Re-evaluate your asset mix. Were you taking more risk than you were comfortable with? Should you take advantage of the market being at a discount? You might want to discuss with your financial professional how you might benefit from the recent market downturn. Are you holding on to more cash than you need in your emergency fund? Talk to your advisor about about if you should put some of that to work based on your goals.

Lean on your advisor. If you are concerned about your investment mix or the current market. Don’t be afraid to reach out and discuss your concerns with your financial advisor. That’s what we are here for! Most of the news you get in the mainstream media is made to scare you into action. Find out what info is out there that directly affects you and your portfolio.

Related: Close to retirement? What should you do if you are close to retirement and the market drops?

Are Bears really that scary?

The bear in my banner above might be scary if you run into him on a hike. Bear markets are uncomfortable to deal with, but if you treat this like a normal part of our market cycle and a decent opportunity to buy good investments at a discount, they might almost warm and cuddly. Maybe I’ll start the movement to re-brand the Bear Market.

What’s your bear market action plan? Do you need to re-evaluate it? If you don’t have a plan or want a second-opinion, email me at Brian@TheAeroAdvisor.com and I’ll be glad to give you a free, 100% no-obligation assessment of your Bear Market strategy.

The opinions voiced in this material are for general information only. They are not intended to provide specific advice or recommendations for any individual, nor intended as tax advice. We suggest that you discuss your specific situation with a qualified tax or legal advisor.

LPL Tracking # 1-05295700

Can't find what you're looking for on our website? Have a question regarding your financial picture? Want to leave us some feedback? We would love to hear from you. You can email me at Brian@TheAeroAdvisor.com or fill out the form below.

By submitting this form, you are consenting to receive marketing emails from: . You can revoke your consent to receive emails at any time by using the SafeUnsubscribe® link, found at the bottom of every email. Emails are serviced by Constant Contact