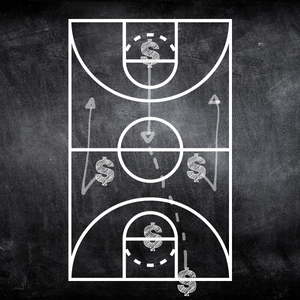

For college basketball fans, March Madness is one of the most exciting times of the year. But did you know that there are valuable lessons to be learned from the tournament that can be applied to 401k investing?

Just like a successful bracket-busting team, a successful 401k investor must have a strategy in place, be adaptable, and stay disciplined. Here are some lessons from March Madness that can be applied to 401k investing.

Create a Game Plan

A successful team making a run through the tournament has a solid game plan, and a successful 401k investor should have one as well. Before investing, you need to determine your financial goals and risk tolerance. Determine how much you want to (or are able to within your budget) contribute to your 401k, what asset investment mix you will use, and what your long-term financial goals are.

By having a game plan, you can stay disciplined and focused on your investment strategy, rather than making emotional decisions based on short-term market fluctuations.

Be Adaptable

March Madness teams must be adaptable to succeed. They must be able to adjust their strategy based on the strengths and weaknesses of their opponents.

Similarly, 401k investors must be able to adjust their strategy as needed. This may involve rebalancing your portfolio, adjusting your asset allocation, or even changing your investment strategy entirely. If your financial circumstances change or some of your long-term goals evolve, make sure to keep your strategy up to date.

For example, many times during your working years, you might have the opportunity to take advantage of lower prices when there is a market downturn. You might increase your contributions during this time to maximize your future return.

Stay Disciplined

In March Madness, teams must stay disciplined and focused on their game plan. They must not let their emotions get the best of them, and they must stick to their strategy even when things don’t go their way.

Similarly, 401k investors must stay disciplined and stick to their investment strategy. This means not letting short-term market fluctuations (think war in Ukraine, inflation, bank failures, etc.) impact your long-term investment decisions. By staying disciplined and focused on your goals, you can ride out market volatility and achieve your long-term financial objectives.

Diversify Your Investments

March Madness teams must have a well-rounded roster to succeed. They can’t rely solely on one- or two-star players to carry the team. Instead, they need to have a mix of players with different strengths and abilities.

Similarly, a successful 401k portfolio should be diversified across different asset classes and sectors. This can help manage risk and ensure that you capture gains in different market conditions. By diversifying your portfolio, you can reduce your overall risk and increase your chances of achieving your long-term financial goals.

Final (Four) Thoughts

Just like a successful March Madness squad, a successful 401k investor needs a game plan, must be adaptable, stay disciplined, and diversify their investments. By applying these lessons to your 401k strategy, you can build a portfolio that aligns with your financial goals and risk tolerance and increase your chances of success over the long term.

So even if the team you picked to win it all isn’t cutting down the nets in Houston in two weeks, I hope you’ll feel a little better about your 401k after the madness is over.

If you don’t have a 401k strategy in place and need help putting one together, we’re happy to help. Email Brian@TheAeroAdvisor.com or fill out the quick and easy form below and we’ll contact you.

Other articles about 401k strategy

The opinions voiced in this material are for general information only. They are not intended to provide specific advice or recommendations for any individual, nor intended as tax advice. We suggest that you discuss your specific situation with a qualified tax or legal advisor.