Newly hired at Lockheed Martin and have questions about the 401k? Your 401k can be a very important part of your retirement plan, so we think it’s important to give it the attention it deserves. We’ll review a few common questions you might have about your new Lockheed Martin 401k below.

If you have additional questions that aren’t answered here, feel free to reach out to me at Brian@TheAeroAdvisor.com or fill out the form at the bottom of this page.

How much does Lockheed contribute to my retirement plan?

For most new employees, Lockheed will contribute 50 cents for every dollar you decided to put in your 401k up to 8% of your salary. So if your salary is $100K and you decide to put in the full 8%, Lockheed will add $4000 to your $8000 contribution for the year.

Depending on when you joined the company you might also get an additional 4% from the company in a separate retirement account called a Capital Accumulation Plan (CAP).

There will be a few additional changes coming in 2020, so be aware of those down the road. For more info on those changes, CLICK HERE

Should I use the Roth 401k option?

The Roth option in the 401k allows you to pay taxes on your contributions now and avoid paying taxes on any of the gains in the account if you take them out in retirement.

If the Roth is right for you or not largely depends on your personal situation, but generally if you have a long time until you retire and think you’ll be in a higher income bracket when you retire (in other words – making more bank) then it might be a good option for you.

For example, let’s say you were putting in $100/month into the Roth 401k option. At the end of the year, your $1200 would be invested in a fund of your choosing. 20 years down the road earning a conservative 4% return (depending on how you invest), your $1200 might have grown to around $2600. So if you pull that $2600 out in retirement to live on, you wouldn’t have to pay taxes on the $1400 you earned. Not too shabby.

How much should I be contributing to my 401k?

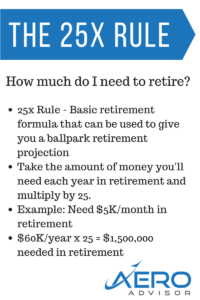

The answer to this one really depends on what you are trying to accomplish. I like to work backwards and start with what size of nest egg you’ll need to live off of when you retire. To get there, we should probably ask a few more questions.

How much would you like to live on in retirement? A general rule I like to use is take whatever you want to live on per year and multiply it by 25. So if you want to live off $100,000 a year when you retire, you’ll need around $2,500,000.

From there you can play with a few retirement calculators on your 401k website to see how much you’ll need to contribute each pay period. Don’t forget to factor in your social security or any pension benefits you might have in your annual income need.

Can I roll my 401k from my old job into the Lockheed Martin 401k?

Yes. You’ll need to contact whoever manages your old company 401k plan to get the correct documents filled out. They will then send the funds over to your new 401k and you can invest them as you see fit.

Check with your old plan provider to make sure if any of your dollars are after tax, as you don’t want to mix those with your pre-tax dollars in your current plan. It can be a little bit of a nightmare to sort out later on.

Have additional questions about your Lockheed Martin 401k? Shoot me an email at Brian@TheAeroAdvisor.com or fill out the form below.