When a new Lockheed client meets with me, one of the first questions on their mind is “Do I have enough to retire?” That’s usually the reason that brings them to set up a time to meet.

Basically, what you are trying to determine is whether or not the 401k and other assets will be able to provide enough income to cover expenses when you stop working. So to figure it out, we need to examine both sides of the question, expenses and income.

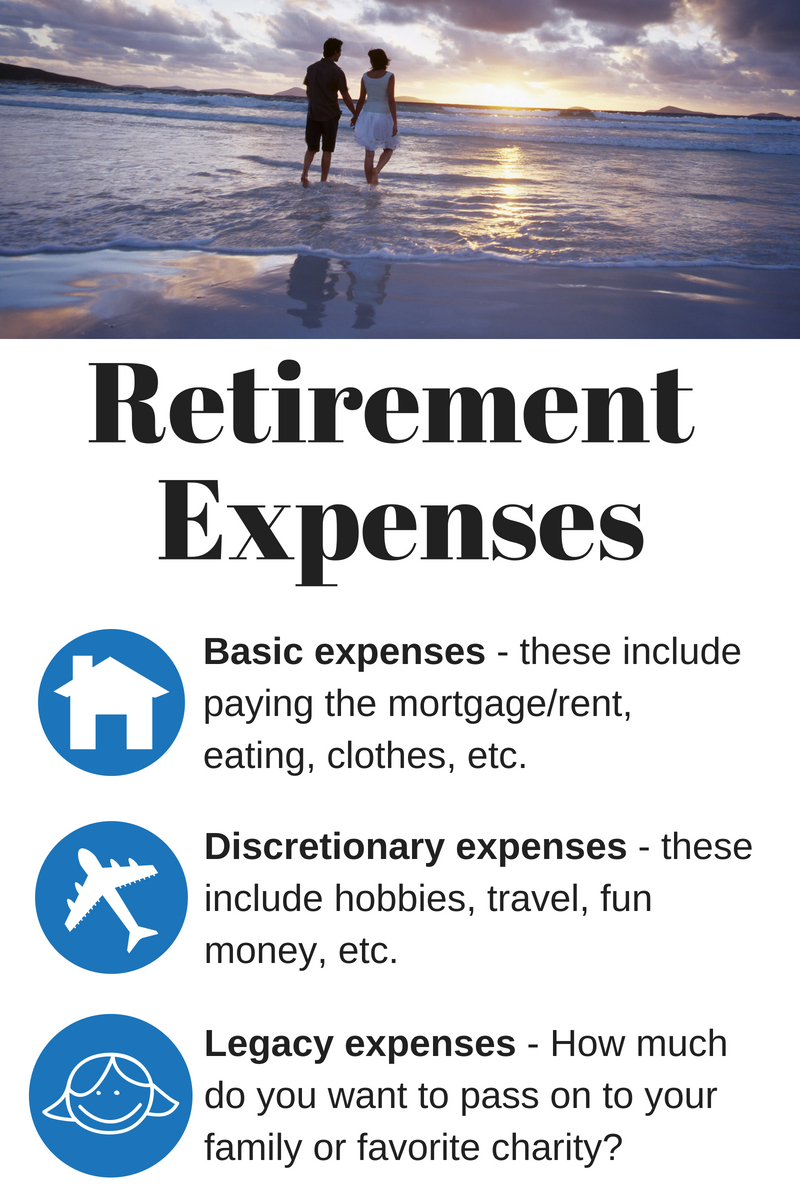

Retirement Expenses

First, let’s discuss the expense side. In other words how much do we need to live, the way we would like to live when we’re not counting on income from a job. This is one item a lot of people that we see don’t have a good handle on. Maybe their income has been high enough to cover whatever they wanted to do. In retirement however, it’s a good idea to at least have a handle on how much money is going out each month.

So we recommend that you spend time analyzing your current expenses and also estimate which of those might go up, go down, go away, or which new expenses might pop up when you’re retired.

So we recommend that you spend time analyzing your current expenses and also estimate which of those might go up, go down, go away, or which new expenses might pop up when you’re retired.

For example if you have young children, your current expenses might not be as accurate as they would be for retirement planning since you won’t have the same expenses for your kiddos like feeding, clothing, sheltering paying for their sports, paying for their entertainment, paying for their cellphone, car insurance, birthday presents, health insurance, etc.

A lot of those expenses will change as kids get older and then hopefully leave your nest and your income statement and balance sheet.

There will also be some expenses that will pop up when you retire. For example if you’re covered by an employer’s health insurance plan and you retire before age 65 when Medicare kicks in, you may have increased cost for private health insurance.

Also if you have a current mortgage on your house, that expense might go away if you pay off your house before retirement (Should you? read more HERE). You might plan to downsize or move to a better location. Depending on how you finance your home, any equity you get out of existing residence might help fund your retirement income.

Don’t forget the fun money!

Besides the basic expenses, you’ll also want to think about how much money you want to set aside for activities. If you are a golfer or like to travel, it’s a good idea to figure out how much discretionary income (stuff that’s not necessary) you’ll need. You can cut back on some of these expenses if things get tight, but make sure you have a little to keep yourself entertained.

So putting together a detailed expense budget is a very wise process and well worth the time. That will give you a sense of a good estimate of how much money you might need on a monthly or annual basis to live on when you don’t have a job to provide that income or don’t want to have a job, and you can’t or don’t have that salary.

Legacy planning

If you’re planning on leaving money to a friend, relative or charity you’ll want to plan to fund these goals in retirement as well. It might mean adding money to a trust account or paying for kids or grandkids’ college expenses. Make sure you have a plan to fund these goals as well

Retirement Income & Social Security

The other part of the equation is your income. There are various sources of income that you might factor into this calculation. These might include a pension (if you’ve been around Lockheed long enough that still get this benefit), social security and income from a retirement portfolio.

Social security benefits, despite the financial issues, will most likely be around in some form or another when you retire. They used to send you a statement in the mail a few months before your birthday, but now you have to log on to their website (SSA.GOV) to get your benefit estimate.

If you have a spouse, then you should have two Social Security benefits, even if only one of the spouses paid enough into the system enough to get credit to earn their own benefit. This spousal benefit can be a great source of income that many don’t realize they have.

Then you can add in any pensions that you might have from Lockheed, a previous employer or a military pension. Lastly, you’ll want to include around a 4% withdrawal rate from your investment portfolio. This might include your Lockheed 401k, IRAs and other investment accounts.

What Next?

Now that you have a good idea of what’s going out and what you’ll have coming in, how does it look? Do you have more expenses than income? If so, maybe you’ll need to re-examine those expenses or decide you might need to work a little longer and save a little more each month.

More income than expenses? Lucky you! You might consider retiring a little sooner or adding a few discretionary expenses like vacations to your expenses. Don’t forget to fund a decent savings account for those emergencies or other unplanned expenses that might come up in retirement.

If you have more questions about retirement or not sure if you’ve saved enough, fill out the form below and I’ll provide you with a free retirement analysis to see where you are at. You can also shoot me an email at Brian@TheAeroAdvisor.com

Content in this material is for general information only and not intended to provide specific advice or recommendations for any individual. There is no assurance that the techniques and strategies discussed are suitable for all individuals or will yield positive outcomes.