When you log into your Empower Lockheed Martin 401k account you might have seen investment options named target date fund 20xx. These are funds you can invest in other than the traditional investment options (S&P 500, common stock fund, broad market bond index, etc.) that have a mix of the other choices.

The investment mix of these target date funds are based on what the last two digits are in the year. Generally, a 401k participant would pick the target date fund with the year closest to their estimated retirement date.

For example, if you were planning on retiring in 2027, you might pick the 2025 target date fund. The funds are invested like you had a seven year investment window (2025-2018 when I’m writing this). As you approach the target retirement year, the funds would get more conservative.

Each target date fund is managed by a portfolio manager that selects what percentage of each investment option in the plan (the S&P 500 for example, developed markets, bonds, etc.) is in the particular fund. For example, the Target Date Fund 2020 has a lower percentage of stocks and more bonds/cash than the Target Date Fund 2050.

Benefits of the Target Date Fund

No need to research. If you select to invest in a target date fund, you are basically off-loading the asset management of your 401k dollars to that fund manager. That manager will do all the research and allocate your retirement dollars in the fund for you.

Very Simple. There’s no need to monitor or rebalance the fund as well. The fund manager will make adjustments to the portfolio of investments inside the target date fund as needed. If a fund needs to be swapped out for another option, the fund manager will do that for you.

Drawbacks of Using a Target Date Fund

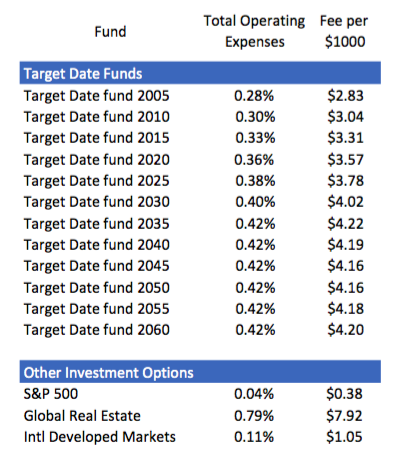

Source: Lockheed Martin 401k summary plan description

Higher cost. The Target Date Funds require a little more work from the fund manager than most of the other funds, so with that comes a little higher cost. See the chart on the right for an example. I listed all the target date funds and a few other investment options for comparison.

As you can see, the target date funds will cost you a little bit more to invest in them. You must weigh the benefits we talked about above to see if that extra fee is worth it for you.

No risk tolerance involved. The target date funds don’t take into account how risk averse you might be. For example, you might be retiring in 2045 but be very conservative when it comes to investments. You might not be able to tolerate drastic swings in the market that might come from a more aggressive portfolio.

In that case, you might consider investing your 401k in a more conservative target date fund (basically pick a year closer to now than your anticipated retirement date). Or you might choose to select the individual investments that might better match your risk tolerance.

On the other side of the coin, you could have an older investor that is ok with higher risk. He or she might be closer to retirement but be ok with more risk in their 401k. That type of investor might look at a target date fund with a year beyond their retirement year.

The target date fund can be a great option for your 401k if you want someone else to manage your assets inside your 401k for you.

Not sure if you’ve invested correctly inside your Lockheed Martin 401k? I’m happy to help. Shoot me an email at Brian@TheAeroAdvisor.com

The opinions voiced in this material are for general information only. They are not intended to provide specific advice or recommendations for any individual, nor intended as tax advice. We suggest that you discuss your specific situation with a qualified tax or legal advisor.